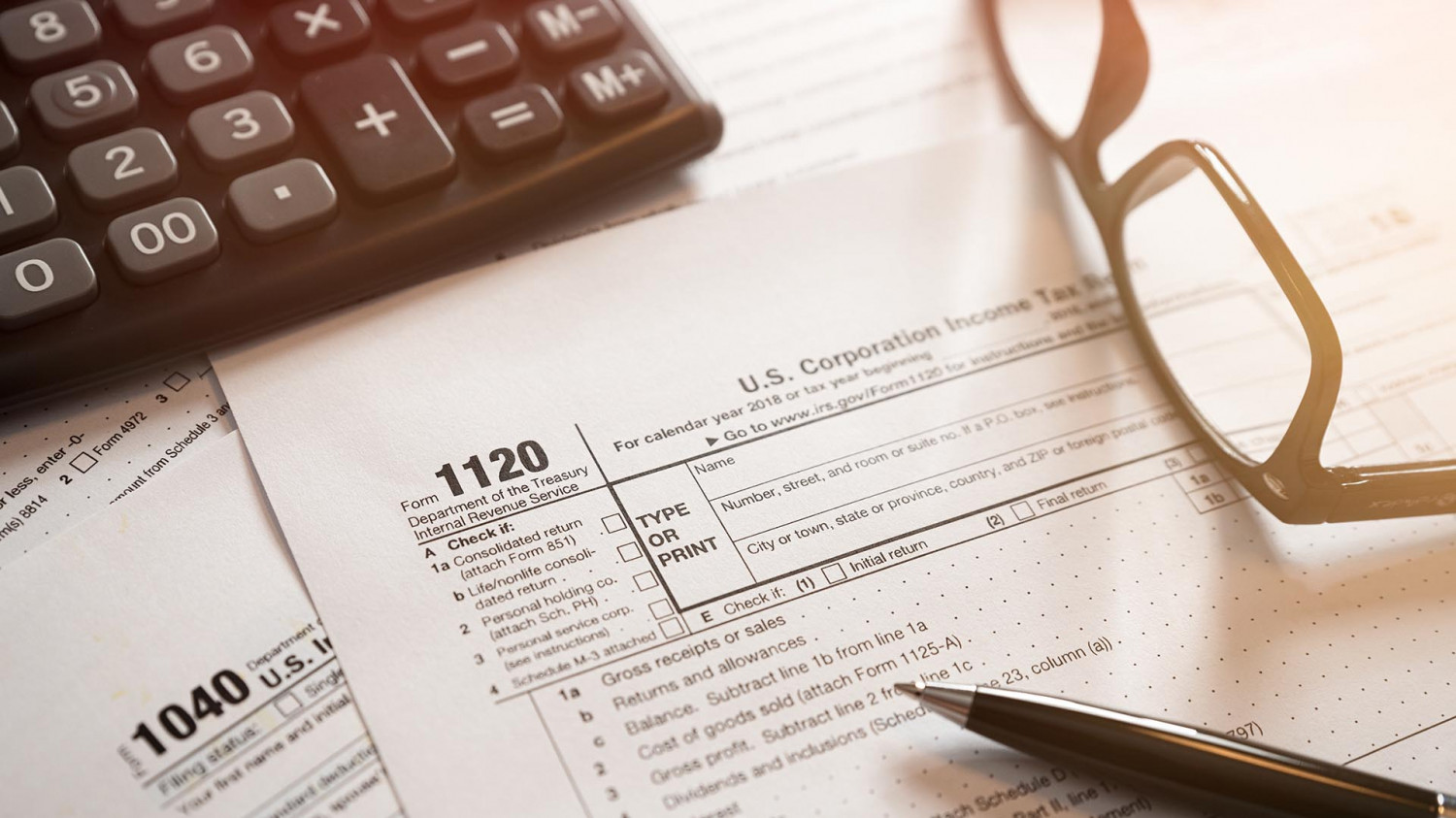

2024 1040 Schedule 4972 – Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2024 1040 Schedule 4972

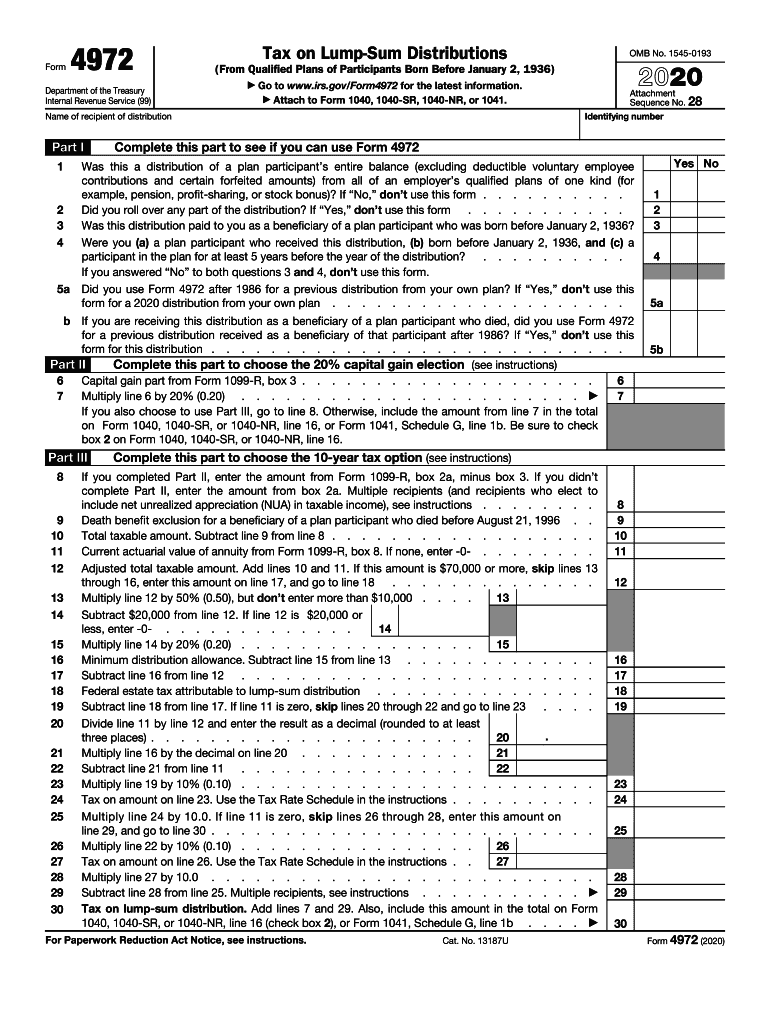

Source : www.taxesforexpats.com2023 Form IRS 4972 Fill Online, Printable, Fillable, Blank pdfFiller

Source : form-4972.pdffiller.comCity of El Paso, AARP offer free tax preparations | KFOX

Source : kfoxtv.comForm 1040 V: Payment Voucher Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comCity of El Paso, AARP offer free tax preparations | KFOX

Source : kfoxtv.comStandard Deduction vs Itemized Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comForm 4972: Fill out & sign online | DocHub

Source : www.dochub.comLimited Tax General Obligation Pledge | Broadband Grant Term

Source : broadband.money1 in 10 Oregon jobs to pay more, following minimum wage hike

Source : www.ocpp.orgAccounting Firm | Marysville, Port Huron, MI | Griffin Accounting PLLC

Source : www.griffinaccounting.com2024 1040 Schedule 4972 Schedule A (Form 1040) Guide 2024 | US Expat Tax Service: You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . You must file Form 1040 and Schedule A to itemize. Some itemized deductions are limited based on a taxpayer’s AGI. Others are restricted to a threshold, or percentage, of the filer’s AGI. .

]]>